Insuring the Road Ahead

Nasdaq: UFCS

Warning: this is a highly-speculative post. Please use it for entertainment purposes only.

Calling an acquisition is incredibly difficult. The hit rate is very low unless there are a ton of signs (aka: Playa Resorts). This is one of those moments when the trail’s pretty faint and the changes leave me wondering what the company had in mind.

Perhaps, UFG Insurance (Nasdaq: UFCS) is considering a sale?

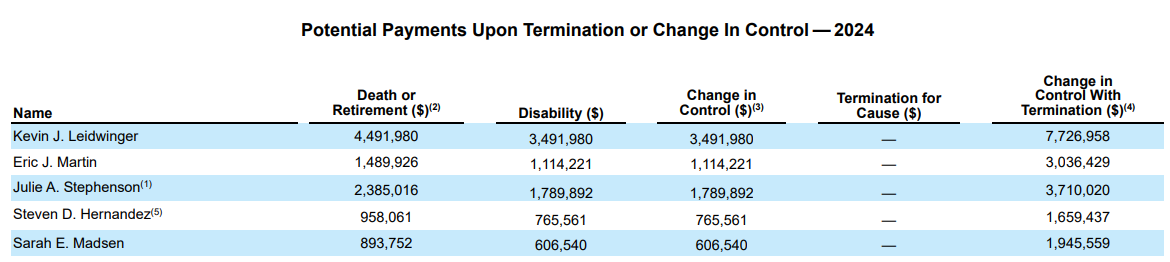

On August 29, UFG Insurance released a Friday 8-K which outlined a new change in control (CiC) agreement for Steven Hernandez, their SVP and Chief HR person. The agreement outlines fairly standard termination benefits that Hernandez would receive in a takeover scenario.

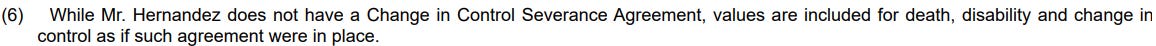

What caught my eye is that Hernandez joined UFG in May 2024 and was the only executive that didn't have a CiC agreement in place. I also found it odd that a Chief HR person (including the lawyer they presumably hired) never requested or negotiated a CiC agreement in the first place, when all other executives already had one.

In the 2025 proxy, UFG went as far as admitting that they knew Hernandez didn't have a CiC agreement in place, but calculated his theoretical CiC payment anyways (see graph and footnote below).

A key question remains: Why did Hernandez get an updated CiC at this point in time?

It's fairly obvious from the above disclosure that this wasn't some oversight from when he was first hired. Had it been that way, they would've fixed the problem when they realized it, and the proxy would contain no such note. That proxy was dated April 8, 2025, so why did they change their mind on the matter a mere four months later?

Maybe the board was reviewing the CiC agreements (out of cycle) because they’re anticipating an acquisition offer…

UFG's share price has been in a holding pattern at ~$30 per share since the Covid-19 pandemic hit. This kind of complacent market performance would definitely ratchet up some pressure on the executive team. Fortunately for them, there is a staggered board structure and a large shareholder that drives the bus. Among the large index fund holders, the McIntyre Foundation holds ~12% of the shares, and is the 2nd largest shareholder behind BlackRock.

The McIntyre Foundation was originally set up in 2009 after the passing of Scott McIntyre, the son of UFG founder John McIntyre. The foundation has a long-time board member, Christopher Drahozal, who has also sat on UFG’s board since 1999. In addition, UFG brought in two board members in 2022 with private equity backgrounds, which could be helpful in running a sale process.

UFG's current CEO was hired in August 2022, with 30+ years of experience, most recently as the COO of CNA Commercial (tied to Loews Corp), and Global Manager for Chubb Commercial. Oddly enough, Hernandez has near 100% resume overlap with UFG's CEO, spending significant time at both CNA and Chubb. Could UFG's CEO be looking out for his pal Hernandez by giving him a new CiC agreement before an acquisition goes through?

Sure, there’s a fair bit of speculation here — but that’s half the fun, right?

PS: On the August 7th Howard Hughes call, Bill Ackman clarified that they would pursue an insurance company acquisition in the $1B range, and expected to announce a transaction “in the fall”. UFG amended the CiC agreement approximately one week later, which seems like too close of a coincidence to me.

As of today, UFG has a market cap of ~$800MM, and a standard 20% deal premium would put it just short of $1B. Only time will tell if Howard Hughes is the ultimate bidder.