I have been trying to identify companies running a sale process ex-ante and I believe that Playa Resorts (NASDAQ: PLYA) might be laying the groundwork.

Playa recently made material changes to its employment agreements with all executives three months before expiration, in addition to giving them a double-dip in LTIP grants. Let’s dive in.

Playa Resorts (Playa) is an owner/operator of twenty-five all inclusive resorts spread throughout the Caribbean totalling over 9,000 rooms. The company went public via SPAC in early 2017 and has traded sideways since then. When the pandemic hit, Playa nearly went bankrupt, but Davidson Kempner provided them with a lifeline in June 2020, mostly in the form of debt financing. Playa then raised ~$125MM in equity proceeds via seasoned offering which helped them materially de-lever.

Fast forward to today, and the company has decreased shares outstanding by ~19% in the last two years, in addition to pushing out all of their debt maturities to 2029. This is a materially different company compared to when it was emerging from the pandemic in 2021.

Suspicious Disclosure

On September 27th, 2024, Playa filed an 8-K at 4pm on a Friday which announced an update to the employment agreements of all executives. It seemed rather odd to me because these agreements were set to expire on December 31, 2024. Although renewing employment agreements more than three months before expiration doesn’t seem that early, the last two times the company renewed them was eleven days (in 2021) and three days (in 2018) before the agreements were set to expire. That material deviation stood out.

Naturally, I set out to compare the old and new employment agreement for Playa’s most important executive, Bruce Wardinski, CEO, Chair of the board, and ~4% shareholder.

The first thing I noticed was the addition of the term “Employer” nearly everywhere where “Playa” was already mentioned in the agreement. This change likely seeks to provide legal clarity for liability and/or enforcement purposes.

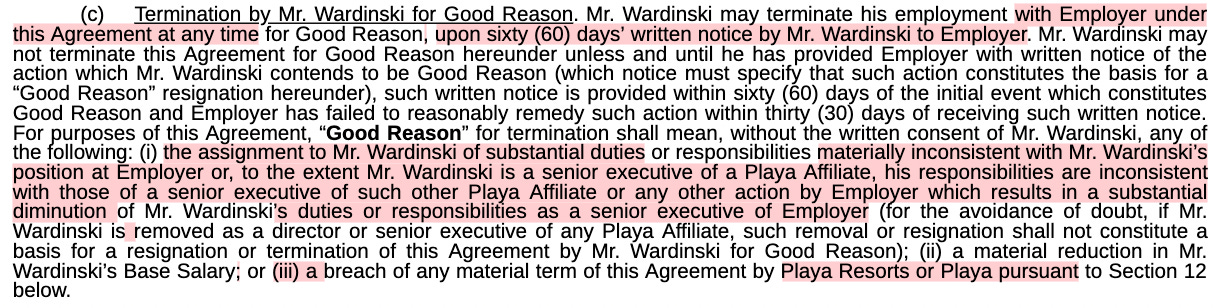

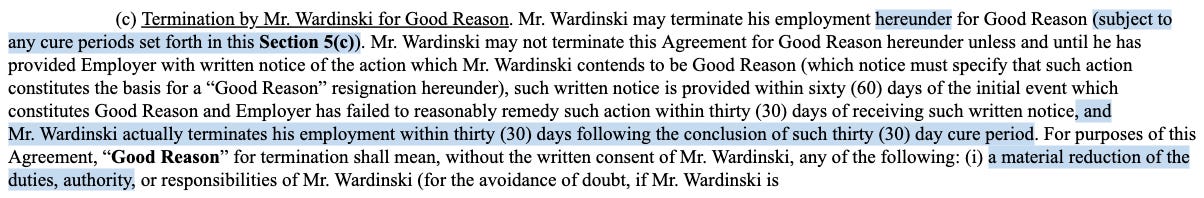

Secondly, I compared the two same paragraphs from the 2021 and 2024 employment agreements, respectively. The red wording is what was deleted from the 2021 agreement and the blue wording is what it was replaced with in the 2024 agreement.

What you’ll notice is that the 2024 agreement is now oddly specific when it comes to defining a material reduction in Bruce’s duties. It specifies a direct reporting to the board, an exact radius for geographic location, and a reporting to “a business unit of a larger public or private company”.

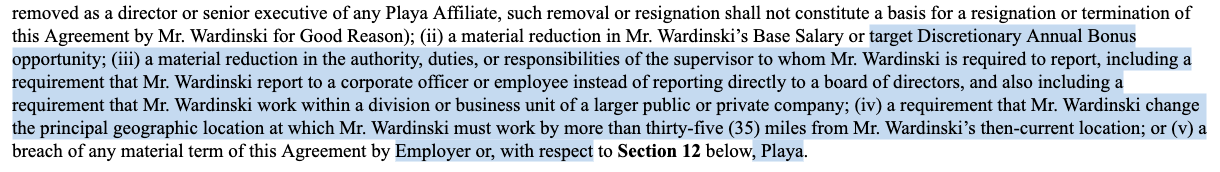

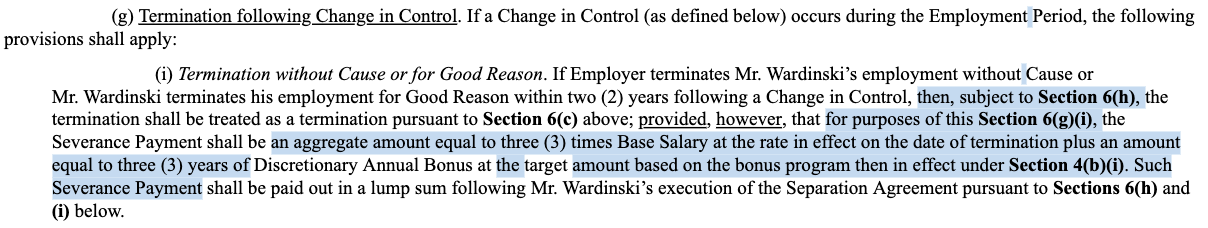

Thirdly, the change of control wording was amended when comparing the 2021 agreement to the 2024 agreement. Similar to last, the red wording was deleted from the 2021 agreement and replaced with the blue wording in the 2024 agreement.

What’s important here is that the old wording was up to interpretation. One could argue that Bruce is owed 2.99 years salary but only 1 years bonus in the old agreement. Most readers would likely interpret it as 2.99 years salary and 2.99 years bonus, but from a legal perspective, it wasn’t 100% clear. The new employment agreement made sure to clarify that point, stating 3 years salary and 3 years bonus.

Lastly, a whole host of clauses pertaining to non-compete, non-solicitation of customers, and non-solicitation of employees have been further refined in an oddly-specific manner. For example, the previous employment agreement noted that Bruce cannot work for anyone that Playa currently does business with. In the new agreement, it now further specifies that Bruce cannot work for anyone that Playa has done business with for the past two years.

LTIP Double-dip

As with anyone trying to predict these things, it’s typically a good “tell” when the board and management have been willing to do things in the past that might tip the odds in their favour.

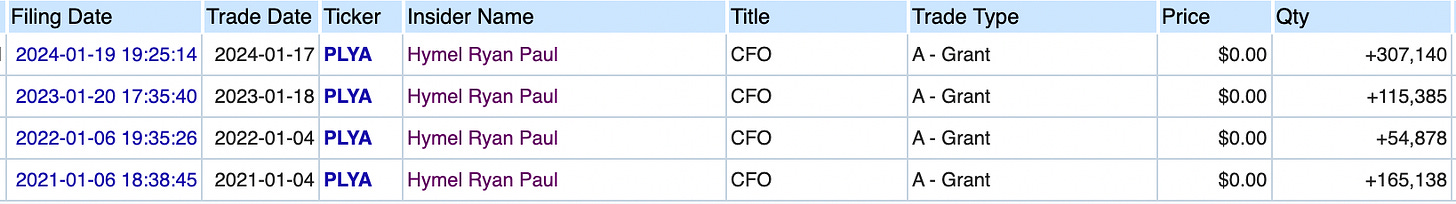

Case in point: Playa’s annual Long Term Incentive Plan (LTIP) grants to executives. The company tends to grant LTIP’s to executives in early January each year, which is ~1 month before they release their full fiscal year results. Normal cadence is seen below for Playa’s CFO.

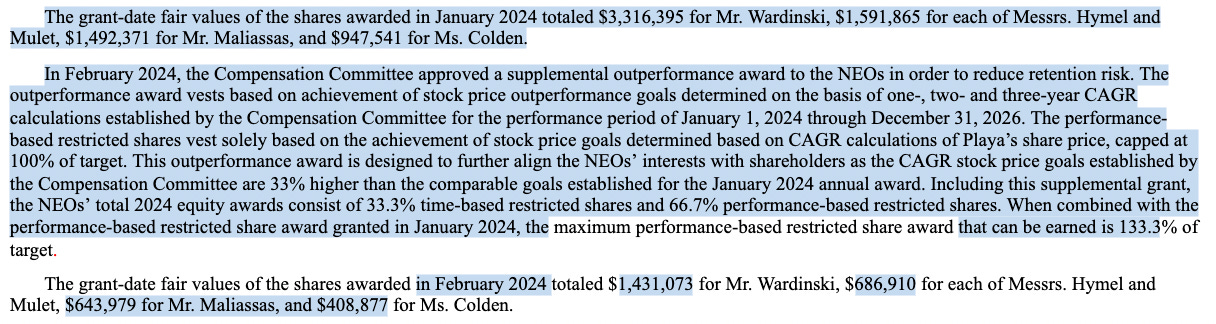

In Playa’s most recent proxy filed on April 22, 2024, a new note surfaced under the LTIP section. The company mentions that they provided all executives with a second LTIP grant just one month after executives were already given their regular LTIP. Proxy extract below.

This double-dip PSU grant is 100% based on stock price CAGR from January 1, 2024 until December 31, 2026. Playa’s stock price on January 1, 2024 was $8.58, which the board thought was likely less than fair value.

I also find it odd that board approved the grant in February 2024, but that the performance period starts one month prior in January 2024. Given that there are no Form 4 filings for PSU’s, the only detail we have to go off of is the paragraph from the proxy.

More Clues

If you were to put a gun to my head, I would venture that Playa is getting its house in order before potentially running a sale process. The period between November (post Q3 earnings) through February is a pretty common time to evaluate strategic alternatives and run a sales process since it syncs well with the annual planning process companies go through.

Here are additional facts that reinforce my conclusion:

The compensation committee chair, Karl Peterson, is an ex-TPG guy.

(Nongaap) has asserted in the past that TPG is know for being very good at governance “dark arts” and incentives.The stock price has been essentially flat for 5 years now, ratcheting pressure on the board to do something about it.

There have been no insider transactions since mid-June 2024. Insiders were previously quite active up until then.

The public markets are not appreciating the value of Playa’s assets via higher trading multiple. Based on my estimates, Playa trades for 10-12x EV/normalized EBIT, which is likely much less than what control buyers would be willing to pay.

As a result of an acquisition of a portfolio of resorts, Playa issued 20MM shares in early 2018 to Sagicor Financial, an owner of many all-inclusive resorts. Sagicor previously sold 10MM shares in January 2021 as the Covid rebound happened. As of today, Sagicor holds 10.9MM shares with the ability to nominate one board member.

Given a weak valuation and 6+ year holding period, Sagicor would likely welcome a sale at a premium.

Playa’s CEO, Bruce Wardinski, is 64 years old and owns ~4% of the business. His stake today is worth ~$41MM and he has not sold stock since Playa’s SPAC transaction in 2017.

Given his position as chairman of the board, Bruce is one of the company’s most powerful individuals and would have the ability to significantly influence outcomes.

Two of Playa’s largest shareholders control a combined 18% of the shares.

HG Vora Capital currently owns ~9% of Playa shares. They are self-proclaimed managers that focus on distressed debt and value situations with a catalyst. They first accumulated a 7.35MM share stake in Feb 2020, slowly increasing it to 12.5MM shares today. Their cost base is likely quite similar to where Playa is currently trading.

Davidson Kempner Capital is an event-driven and opportunistic firm, and currently owns ~9% of Playa shares. One could argue that the original distressed debt and common share purchase during the depths of Covid have largely played out successfully for the firm. I would not be surprised if they were looking to exit given that their thesis has more than played out.

As with any event-driven governance situation, it is truly impossible to know what is happening behind closed doors. Based on the the facts laid out above, I believe that there is a decent probability that Playa runs a successful sale process resulting in a material takeout premium.

Good writeup

Spot on so far! Please continue posting, I really appreciate your unique angle of attack.

https://newsroom.hyatt.com/Hyatt-Discloses-Exclusive-Discussions-with-Playa-Hotels-and-Resorts-NV