Land has always intrigued me. It has near unlimited uses, which provides it with a similar level of optionality. However, it doesn’t usually cash-flow.

If there’s one investment that is particularly ill-suited for public markets, it’s probably non cash-flowing land.

Enter Alico.

At a high level, Alico owns ~53k acres in various parts of central Florida. It uses the majority of this acreage to grow and harvest oranges which are largely sold to Tropicana.

In January 2025, the company announced its intention to become a diversified land company and seek out the highest and best uses for its land. That meant exiting the orange farming business and pivoting its focus to its developable acreage.

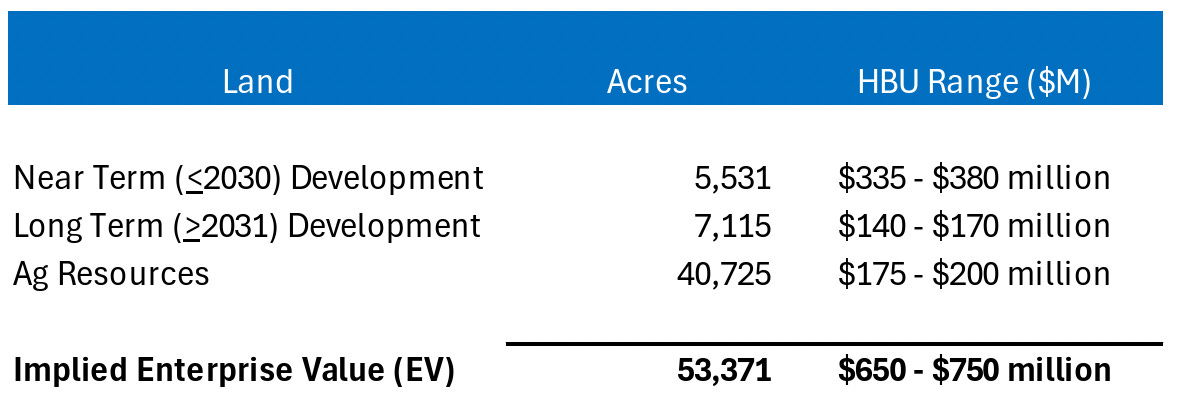

The company put out the following presentation for investors outlining land uses as well as potential valuations. As of today, Alico’s enterprise value is ~$330MM.

Other than the sum-of-the-parts value-investor bait, some have also pointed to the CEO’s incentives as particularly bullish. I decided to take a closer look.

Alico’s current CEO, John Kiernan, was promoted to the President/CEO role in 2019. Given that he was a named executive at Alico before this, Kiernan had an existing employment agreement with Alico from 2015.

On April 1, 2022, Alico and Kiernan entered into an amended and restated employment agreement. The important parts of this new agreement are as follows:

The agreement runs until September 30, 2024

A real estate bonus earned upon the sale of non-citrus acreage

0.6-1.1% of net sale proceeds so long as minimum price per acre metrics are met

A transaction bonus earned upon a change of control

If Kiernan were to sell the entire company for a price above $35/share, he would get a bonus of anywhere from 0.25-1.25% of Alico’s ending market cap.

The bonus would be worth as little as ~$668k at $35/share, to more that ~$5.25MM at $55/share

Restricted stock grant with stock price targets

5,000 shares at $35/share ($175k of value)

12,500 shares at $40/share ($700k of value)

20,500 shares at $45/share ($1.71MM of value)

Other ROIC, EBITDA and cashflow-dependent bonuses

In a filing after 4pm on December 23, 2024, Alico and Kiernan entered into a second amended and restated employment agreement. This was almost three months after his previous agreement had already expired. In addition to other minor changes, this new agreement:

Extended his term to September 30, 2027

Slightly increased his salary to $525k

Provided new price-based restricted stock grants which had the exact same terms as the 2022 grants. These new grants would need the stock price targets to be achieved by September 30, 2027.

Based on my review of managements presentation comments, it seems that Alico will be leasing its farming acreage to a third-party who will grow crops other than oranges. This will provide some stable income going forward to cover overhead.

With the help of its new EVP, Real Estate (hired May 2024), Alico will look to rezone most of its non-agriculture land to residential/commercial. Alico management has not clarified if they will sell the parcels once rezoned, or if they will contribute “land equity” into a joint venture with a developer.

While this pivot was taken positively by the market (Alico stock increased ~20% on the announcement), I’m not sure this situation is as attractive as it may seem. The ~50% discount to the underlying land value is attractive, but land development notoriously takes a very long time. It’s measured in decades, not years.

Even-though Alico’s CEO has grants with stock price incentives that expire in 2027, these collectively aren’t worth all that much. On one hand, the CEO could sell the business today, and maybe get a mid single-digit million payout. Or he can “transform” the business into a real estate holding company that will need 5-10 years to re-zone and monetize their most valuable acreage. In the latter scenario, the CEO collects millions in salary, bonuses and equity compensation for years to come.

Unless significant cost-cuts are made, the drag from corporate overhead will start to slowly eat into the discount to NAV.

While I can overlook some of these negatives, I also suspect that Alico engaged in some “dark arts”.

Based on the most recent proxy filed on January 15, 2025, Alico says that they do not grant equity in anticipation of the release of material non-public information (MNPI).

I would argue that they did just that.

The CEO’s new employment agreement was amended on December 23, 2024 (red circle below) which granted him equity based on stock price targets. Two weeks later (January 6th, 2025), the company announced their transformational plan to unlock the value of their land, which sent the stock price up ~20%.

The stock chart doesn’t lie…

Many have turned bullish on Alico recently because of this transformational plan but I remain skeptical.