'Tis The (Activist) Season

NYSE: NHI - National Health Investors

National Health Investors (NHI), a US seniors housing REIT, appears to be under significant pressure to unlock shareholder value.

Previously targeted by an activist, NHI now finds itself updating risk factors and amending their Change in Control Severance Agreements going into proxy season…

NHI first came under pressure in April/May 2024 when activist investor Land & Buildings (L&B) announced their intention to vote against two NHI directors as a result of conflicts of interest, misaligned incentives, and poor corporate governance. L&B did not solicit proxies at that time.

Fast forward to April/May 2025, and L&B launched a proxy contest to elect two of its nominees to the board. Although both ISS and Glass Lewis recommended the L&B nominees, L&B fell short in a closely contested vote.

While the previous activism is fascinating, I find myself looking at two recent disclosures that seem to hint that more is to come:

November 6, 2025: 10-Q updated risk factors

NHI added the following risk factor: “Stockholder activism efforts could cause us to incur substantial costs, divert management’s attention and have an adverse effect on our business.”

This risk factor was not present in the previous filings and confirms that activists are once again circling.

December 19, 2025: 8-K amended the Change in Control Severance Agreements

The company amended the CiC agreements for each named executive.

The main changes made to the President/CEO’s CiC Severance Agreement include:

Added two line items to the “Change in Control” definition

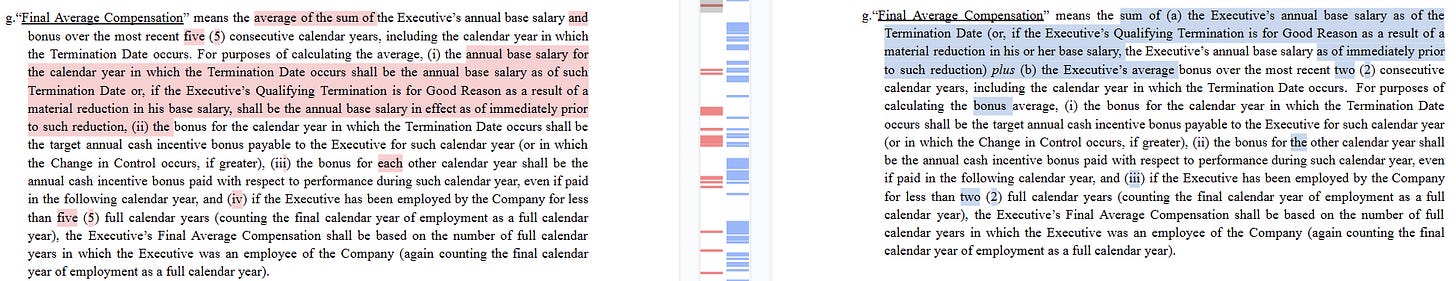

Changed the “Final Average Compensation” definition to include an average of the previous two years earnings, instead of the last five years earnings (red was deleted; blue was added).

Increased the Change in Control severance payment from (2 x Final Average Compensation) to (3 x Final Average Compensation).

Removed part of the “Good Reason” definition as it relates to NHI ceasing to be publicly traded (red was deleted).

Added restrictions to the “Non-Compete” portion of the agreement to include non-solicitation of customers and employees.

Added restrictions on not being a board member, consultant, or advisor to competing companies for 12 months.

In my opinion, the changes to the CiC Agreements are oddly specific. So specific that the only reason an expensive lawyer would be making the changes is if there was an important reason to do so.

One can interpret these changes in one of two ways:

The activist pressure behind the scenes could lead to board turnover, which may result in executives losing their jobs or lead to an eventual sale of the company. Amending the CiC agreements is purely precautionary and is a self-preservation tactic.

The board is putting the company up for sale and is ensuring that executives are aligned to follow-through with the process. In this case, amending the CiC agreements is a result of a change in board strategy.

NHI is small relative to industry bellwethers Welltower and Ventas and could prove to be a good bolt-on acquisition for them. Its stock has lagged both companies since pre-pandemic, and I can think of one quick way to help close that gap.

“♡ Like” this piece if REITs are value traps until they’re sold.

PS: NHI has an upcoming master-lease maturity in December 2026 that is well-below market. L&B estimates that a renewal at market rates could increase NHI FFO by ~12%.