Royalties: Great business models in tough industries

What could be more attractive than owning a top-line royalty that is trading at a reasonable price? Not much, I’d argue. Royalty companies aren’t anything new but I don’t think the small ones get the attention they deserve in the market.

Labrador Iron Ore Royalty Corporation - TSX:LIF (Labrador Iron) is a royalty company that owns interests in an open pit iron ore mine located in Newfoundland and Labrador. The mine is in a remote part of western Newfoundland and is connected to a port in Quebec via a 418 km rail line. Labrador Iron holds a 7% revenue royalty on the mine in addition to a 15.1% stake in the underlying mining company, IOC. Rio Tinto and Mitsubishi Corp own the remaining 58.7% and 26.2% of IOC, respectively.

The mine has been operated by IOC since 1962 and is unique in its supply chain integration. IOC owns the mine, the excavation equipment, the processing plant, the concentrator, the pellet plant, the rail-line, and the marine export terminal. The mine itself is extremely low cost and hasn’t temporarily shuttered since it began operating. It even posted positive net income in 2009, 2015 and 2020; all times of significant commodity price downturns.

As expected, commodities are subject to fluctuating prices, and iron ore is no different. Since 2000, iron ore has been priced as low as USD$20/MT and as high as USD$200/MT. IOC estimates that its breakeven cost is USD$50/MT, which is thought to be top quartile. Much of this low cost is due to the mine having very high-grade iron ore, as well as IOC’s fully-integrated operations. An iron ore price chart in $USD/MT has been provided below to demonstrate the fluctuations in price. Please note that the prices relate to the most basic iron ore concentrate.

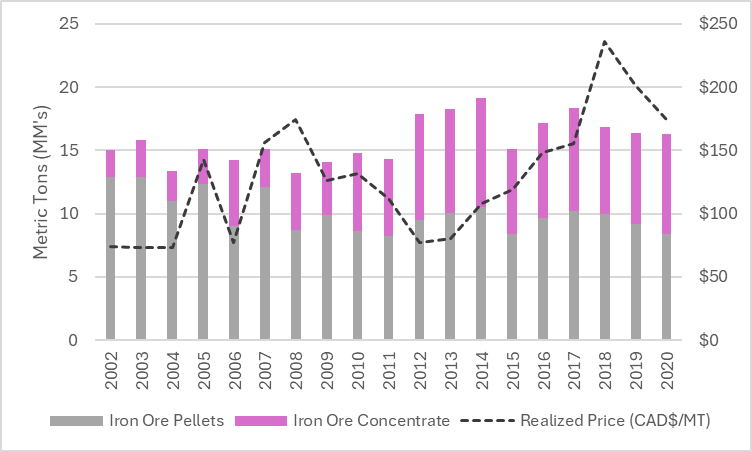

Labrador Iron’s royalty revenue is generated based on a 7% royalty rate, multiplied by the amount of iron ore pellets and concentrate sold (in metric tons), and multiplied by the end sales price. Overall production volume at the mine is quite steady, but changes in the realized selling price are drastic. A chart highlighting the mine’s historic metrics is provided below.

The mine’s production is ~45% iron ore concentrate and 55% iron ore pellets. When lower grade iron ore is excavated from the open pit mine, IOC further concentrates the iron content to 65%. It then has the option to export this concentrate directly to buyers, or decide to further refine the concentrate into higher-value iron ore pellets. Refining the concentrate into pellets is ideal because they can be used in blast furnaces directly by customers, which commands a premium price in the market and is more environmentally friendly. During market downturns, steel producers generally opt for concentrate instead of pellets, due to the lower cost.

To value this royalty stream, one needs to make assumptions about future iron ore prices. I have no special insight into this other than erring on the side of caution. Post-Covid, iron ore prices have increased significantly, which is unsustainable longer term.

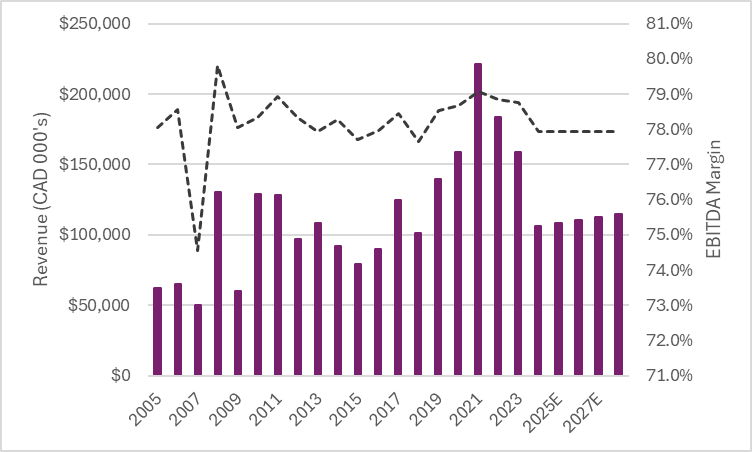

I estimate a mid-cycle iron ore price of CAD$120/MT (USD$88/M), which would generate CAD$106MM in EBITA (adding back royalty amortization). Given the remaining mine life of ~21 years, I believe one should pay at most 10x EV/EBITA, which implies a value of CAD$1.06bn to the royalty stream. Labrador Iron’s royalty revenue and EBITA margin is provided in the chart below.

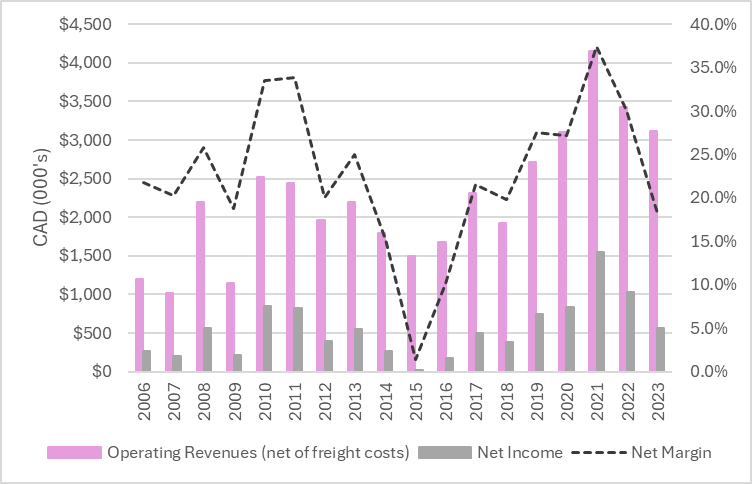

Labrador Iron’s 15.1% equity stake in the underlying mining company, IOC, isn’t as easy to value though. IOC’s mining revenues and net income fluctuate tremendously based on realized iron ore prices, and full financial statements for IOC are not disclosed.

In addition to the mining operations, IOC owns and operates the QNS&L rail line which transports IOC’s iron ore, as well as 3rd party iron ore to port in Quebec. Disclosures relating to the rail line are sparse but last year, QNS&L hauled 17.7MM metric tons of iron ore for 3rd parties such as Champion Iron Ltd., Tacora Resources Inc. and Tata Steel Minerals Canada Ltd. This is in addition to the ~17MM metric tons it already transports for IOC. At an estimated transportation revenue of $5/MT and 17.7MM metric tons hauled in 2023 for 3rd parties, the rail line likely provides significant stability in revenue and earnings for IOC.

The chart below provides IOC’s high-level metrics since 2006. Full financial statements for IOC are not disclosed.

Given the lack of detailed disclosure of IOC financials, I estimate mid-cycle revenue, net income, and net margin of $2.3bn, $500MM and 21.7%, respectively. IOC has no net debt, and their most recent disclosure states a net working capital position of $500MM. Given this, and the inherent cyclicality in the industry, I believe a p/e ratio of 10x on mid-cycle earnings is tough but fair. At that multiple, IOC would be valued at CAD$5bn, and Labrador Iron’s 15.1% stake valued at CAD$755MM.

While my valuation is just an estimate, there are some external data points to consider. Rio Tinto tried to sell in 2013 and it was reported that they were seeking a valuation of USD$3.5-4bn for their 58.7% stake in IOC. In 2018, it was once again reported that Rio Tinto was testing the market to sell their stake. This time, they wanted USD$6bn for their 58.7% stake in IOC. It was reported that Rio Tinto was a seller because their IOC stake is a non-core asset.

While these are dated reports, they do help to narrow IOC’s valuation from the perspective of its controlling shareholder. These two marks would value Labrador Iron’s IOC stake at CAD$0.92-1.05bn in 2013 and CAD2.0bn in 2018.

Labrador Iron’s current market cap and enterprise value is CAD$1.92bn and CAD$1.91bn, respectively. Summing my royalty value, my IOC value, and the excess cash provides a value of CAD$1.83bn. Seemingly, there isn’t much upside from a trading multiple standpoint, but the downside is also somewhat limited.

From a return of capital perspective, I think Labrador Iron is potentially interesting. Based on my mid-cycle estimate of royalty EBITA taxed at 30%, and the 15.1% attributable to IOC’s earnings, I estimate a distributable income after tax of CAD$150MM. This represents a 7.8% yield on the current market cap or a p/e multiple of 12.8x. Add in a few percentage points of commodity price inflation per year relative to the underlying currency, and one could possibly calculate a 10% return.

As with any investment, Labrador Iron isn’t without its risks.

It has exposure to a single mine location, which can be subject to natural disasters or stoppages in work. I find that this can be mitigated via a smaller position size.

Labrador Iron’s active mining leases expire in 2050-2052, with an unknown probability of renewal. The mine has an expected reserve life of 21 years (until 2045), so the lease expiration is generally a moot point. Investors are paying an estimated p/e multiple of ~13x, which is significantly less than the indicated remaining reserve life.

China accounts for ~70% of all seaborne iron ore demand for steel production; therefore, production is inextricably linked to China’s economy. It’s important to note that China is home to many steel production facilities that export significant amounts of steel to other nations.

The company’s royalty revenue and 15.1% IOC stake are heavily influenced by underlying iron ore prices. I have tried to mitigate this by taking a mid-cycle estimate of earnings, but I have also included a sensitivity analysis in my model at the bottom of the article.

Labrador Iron’s executive team has tried (and failed) to amend the company’s articles multiple times in order to make new royalty acquisitions and dilute existing shareholders. The company’s articles require a 75% voting threshold for amendments, which is a very high bar and dissuades future attempts. The company’s articles also restrict its business to owning/managing a royalty and mining interest in Labrador city, as well as holding cash to be paid out to shareholders. I find that the company’s articles of incorporation are an effective handcuff in restricting the executive team from making poor capital allocation decisions.

In my opinion, it’s easy to envision a future where Labrador Iron continues to earn and distribute significant amounts of cash to shareholders for a very long time. At a 7.8% earnings yield, it isn’t excessively cheap, but the risk is also commensurately low.