Revving Up

BRP Inc. - TSX: DOO

Boards, just like people and corporations, only have so much political capital. Favours are given (or called upon) and this political capital accumulates (or depletes) with time.

The Board of BRP Inc. recently put forward a resolution to exchange a bunch of out-of-the-money options held by employees and replace them with special Restricted Stock Units (RSUs). This is a move not commonly made, since it has some similarities to the options repricing that occurred in in the late 1990’s.

ISS, Glass Lewis, and institutional shareholders won’t be happy with this move but shareholders must go along with it because BRP is largely controlled by Bain and the founding Bombardier family.

BRP’s board is knowingly using some of its political capital by doing this, so you can be damn sure that they’ve thought this through.

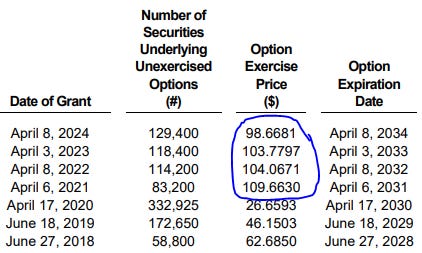

On April 23, 2025, BRP released its 2025 proxy which outlined a proposed resolution that caught my eye. The stated purpose of the proposal is to ensure the ongoing retention of executives and employees of the company, given that many of the stock options issued to them in 2021, 2022 and 2023 are now significantly out-of-the-money. With BRP trading at ~$53 per share today, a sample of the historical option grants below makes their case.

Here are the pertinent details of the planned exchange:

Exchange out-of-the-money stock options for RSUs

Voluntarily forfeit 70% of all 2021-2023 options

The eligible options consist of a total of up to 680,505 stock options and have exercise prices ranging from $88 to $123

264,300 eligible options (representing 38.8% of all eligible options) are held by 13 insiders of the corporation

BRP’s CEO is not eligible to participate in the exchange

Up to 272,202 special RSUs are proposed to be granted, which represents one special RSU for each 2.5 eligible options

The RSUs are to be cash-settled and will vest during specified periods ending no later than December 31, 2028

Here’s the math on what that the grant looks like at different prices:

$53 per share (current price)

680,505 options: worthless, other than time value

If you want to get technical, a Black-Scholes estimate would peg the value reasonably high given the 7 years to maturity and high implied volatility.

272,202 RSUs: ~$14.4MM

$25 per share

680,505 options: worthless, other than time value (same caveat)

272,202 RSUs: ~$6.8MM

$100 per share

680,505 options: breakeven plus time value (same caveat)

272,202 RSUs: ~$27.2MM

From an employee perspective, RSUs are generally preferred given they have value in all scenarios, are easy to understand, and don’t need heroic increases in the share price to be in-the-money. While the options do have mathematical value, regular employees tend to not ascribe much value to options when they are deep out-of-the-money. At the end of the day, it’s all about perceived value from the employee perspective.

The RSUs granted to the 13 insiders equate to ~$5.6MM of value at today’s stock price, or ~$431K per employee. I would estimate that the median BRP insider probably makes ~$250K per year, which makes this grant reasonably significant, especially if one also believes that the stock is currently inexpensive.

BRP is admittedly the ultimate consumer discretionary company. The Sea-Doos, Ski-Doos, and Can-Am ATVs it manufactures are large purchases that can be deferred (or accelerated) based on current and perceived future wealth; therefore, valuation should be based on mid-cycle revenues and margins. I estimate mid-cycle revenue and EBIT margins for BRP to be $6.5B and 9%, respectively. This results in $585MM of EBIT, which seems fair given that maintenance capex and amortization generally equal each other. Readers can pull historical financials to determine whether I’ve been too conservative or aggressive with those assumptions.

On an EV/EBIT basis, I estimate BRP to be trading at ~11x (~15x based on EV/NOPAT). There is a high (but manageable) debt load here, so beware the use of levered multiples. For a company that has multiple market-leading franchise brands, can invest more in R&D relative to competitors, and can grow earnings into the future, I believe that is a reasonable price to pay.

The key questions that I come back to are: Who decided on the option exchange? Why are they doing the exchange now? And is the exchange informed by valuation?

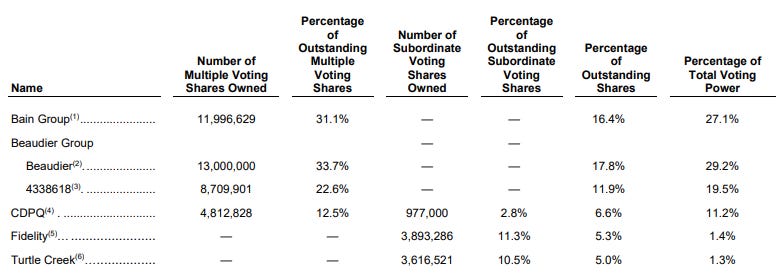

BRP has two classes of shares:

34,512,676 subordinate voting shares with 1 vote each

38,519,358 multiple voting shares with 6 votes each

As I alluded to earlier, Bain and the Bombardier family (now Beaudier) effectively control the company. There is a nomination rights agreement in place whereby Bain, Beaudier Group, and CDPQ are entitled to designate three, three and one member(s) of the board, respectively. Bain has elected to only nominate two directors to the board, one of which sits on the compensation committee.

Bain has been involved with BRP since 2003 and have been opportunistically selling down their stake in secondary offerings or selling into large share buybacks. More recently, Bain did a bought deal secondary offering in April 2024 for 1.5MM shares (~11% of their stake) at $92.90 per share. This provides a decent estimate of where sophisticated insiders see valuation. Overall, Bain’s private equity history would lead me to believe that they could have had a part in orchestrating this exchange.

While Bain and others are the ultimate decision makers at the board level, one must wonder what the impetus is for doing the option exchange. After all, this decision doesn’t set the standard for good corporate governance.

What we do know is boards do not routinely exchange options for RSUs. This is an active decision by the board, which would need to be disclosed on the main page of the proxy. We also know that there’s no requirement to action the exchange during any specific time of the year.

The board actively chose to approve it on March 25, 2025, subject to approval by shareholders. On March 25, BRP stock was trading at ~$50 per share, a low not seen since the depths of the covid pandemic.

Secondly, one could argue that a firm-wide special retention grant is the exact opposite of what a public company would want to do during a cyclical downturn. Why not let natural attrition work to your advantage instead of having to lay people off during the downturn.

There are really only a few reasons to do this:

The special RSU grant was actually conceived to retain key personnel since the company wants to come out of the downturn stronger than before.

For truly long-term shareholders, this should be seen as a positive, given that competitors may not be doing the same.

The special RSU grant occurred because a large group of key employees complained about their compensation.

Employees that receive stock options and RSUs tend to be in mid/upper management and have decent pay. I find it unlikely that people would overly complain about compensation, especially during a downturn with industry-wide layoffs on the table.

Bottom line: the board is using up some of its political capital to undertake the option exchange. If they grant these special RSUs and the stock price goes down another 50%, then there’s not much of a point in doing so. If they grant the RSUs and the stock price increases 50%, then that has substantially more firm-wide retentive value. Timing is reasonably important.

With the stock currently trading at a reasonable valuation, I think a long-term position in BRP is warranted given its business quality. The decision by the board to approve the option exchange when the stock was at ~$50 suggests they see little long-term downside at that price.

PS: BRP has disclosed that they have limited exposure to products affected by tariffs and has doubled down on powersports by selling its loss-making aluminum boat segment.