Predicting Applovin

Using Governance Changes to Predict Outcomes

Before I started writing publicly, I did a few test-runs to see if I could come up with some governance “dark arts” ideas.

One of those first ideas was Applovin (NASDAQ: APP) and was originally written on March 27th, 2023. I’m not sharing this to take a victory lap (couldn’t be further from the truth because I never actually bought any). I’m releasing it to show that reading the tea leaves based on governance changes can be very difficult but potentially rewarding.

The red circle in the stock chart below indicates when the “dark arts” grant occurred (~$12.50 per share). Even if you ignore the recent vertical move in the stock, it was easily a 10-bagger from the grant date. I think management had special insights about the company’s future prospects and bet heavily through executive compensation changes. This was essentially legal insider trading.

Find the original post below, previously written on March 27th, 2023.

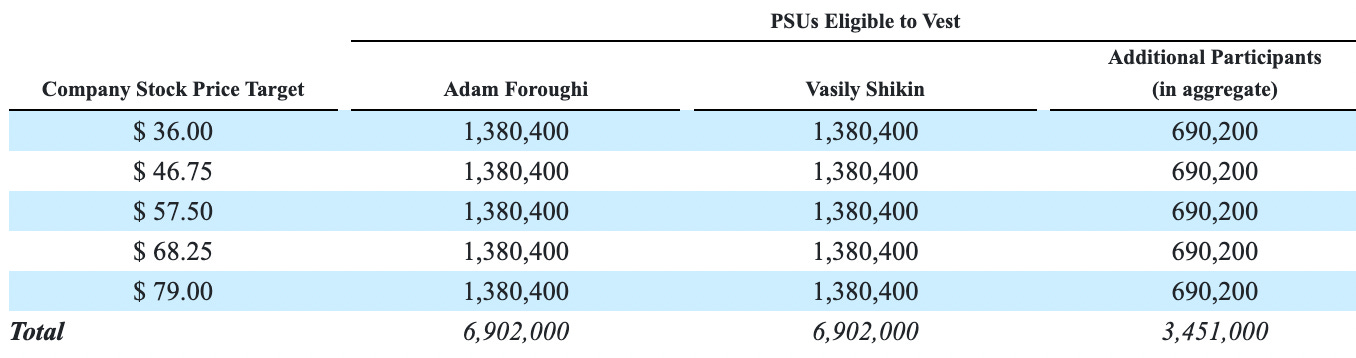

On March 13th, 2023, the AppLovin (Nasdaq: APP) compensation committee granted significant performance-based restricted stock units (PRSU’s) to the company’s CEO and CTO, as well as a small minority of executives. The PRSU’s comprise a total of 17.255MM class A shares, with the CEO and CTO receiving approximately 80% of the grant. For context, AppLovin’s most recent 10-K listed 305MM and 71.1MM Class A and B shares outstanding, respectively. This grant award is significant in terms of potential dilution to shareholders, as well as dollar amount, given the stock price at the time of the grant was ~$12.50/share.

What made this grant rather peculiar, is that the compensation committee explicitly noted that this grant would be in lieu of the CEO and CTO receiving equity grants for the next 4 years. This equity grant is significantly front-loaded.

The PRSU’s vest solely based on stock price targets which range anywhere from $36-$79/share; a significant premium to the stock price at the time of the grant. The PRSU compensation breakdown is highlighted below.

In addition, the 8-K release included the following paragraph: “In the event of a change in control of the Company following the Grant Date but before the end of the performance period, the PSUs may be eligible to vest in additional amounts if the per share transaction price in the change in control is above the Threshold Price but below an additional Company Stock Price Target(s) that has not previously been achieved, in which case the additional amount of PSUs will vest immediately prior to the closing of the change in control.”.

What this disclosure seems to imply is that if a change of control occurs at $40/share for example, that the PRSU amount of shares vesting is not just 1.38MM + 1.38MM + 0.69MM = 3.451MM shares. It appears that “additional” PRSU’s shares may be granted to executives even if the stock price does not achieve the next rung on the PRSU compensation table.

Based on the above disclosure, I decided to read through the company’s most recent proxy statement (April 27, 2022) to see if there are any other governance clues I could pick up on.

In governance analysis, timelines and the dates of disclosures can provide clues as to what may be going on behind closed doors. AppLovin filed its 10-K on Feb 28, 2023 and then disclosed the equity grants on March 13th, 2023. Upon completion of a fiscal year end and the filing of the company’s 10-K, the board of directors typically holds year-end strategic meetings to plan objectives for the upcoming year. If major strategy changes were to occur at the board-level for a public company, they would typically occur during the period from February to May.

Changes to executive compensation are also interesting to look at. In the past, AppLovin typically granted its executives a base salary and RSU’s. The vesting schedule was generally over 5 years and only had a time-vesting requirement. The March 13th equity grant is at-odds with their typical granting practices.

To approve an equity grant such as the one discussed above, one needs to look at the compensation committee next. AppLovin’s current compensation committee only comprises two individuals, which is a significant red flag. Compensation committees should have a minimum of three individuals to ensure appropriate internal controls.

The chair of AppLovin’s compensation committee is Edward Oberwager, a private equity partner with KKR and director of AppLovin since 2019. In general, private equity companies demand board seats when making significant investments in businesses, but it is a lesser-known fact that they typically desire a seat on the compensation committee. A compensation committee can heavily influence a business's strategic direction.

KKR invested in AppLovin in mid-2018, a few years before it made its initial public offering on the Nasdaq in April 2021. As of the most recent proxy, KKR owned 60.7MM Class A shares and 38.9MM Class B shares. The Class A shares have 1 vote per share, while the Class B shares have 20 votes per share. The other significant holder of the Class B shares is AppLovin’s CEO; which also happens to be one of the recipients of the March 13th equity grant in question.

De facto board and voting control rests in the hands of KKR and AppLovin’s CEO. Given the close relationship between KKR and AppLovin’s CEO, it is not surprising that the proxy is littered with related party transactions.

Conjecture/ implication based on disclosures: Since going public in 2021, AppLovin’s stock price has suffered a 75% drawdown along with most of the tech sector. Given that the typical private equity fund life ranges anywhere from 5-7 years, KKR’s ongoing investment in AppLovin is at the start of the typical exit-period for a private equity firm. The board of directors likely made a strategic change at the end of the fiscal year and have decided to put the company up for sale. To incentivize current management in this direction, the KKR influenced/controlled compensation committee devised a change to the equity grants for the CEO and CTO, which are now heavily front-loaded and provide payouts at significantly higher stock prices. Based on typical deal timelines, it would not be surprising if AppLovin was acquired within the next 6 months, with the CEO and CTO gaining a significant windfall from the March 13th equity grants.

My end-state conclusion on Applovin was obviously wrong, but the writeup was directionally correct. Predicting is hard.

Incredible find & reading as always. Really enjoying the Dark Arts ideas ! I recall something similar in XPOF & the new CEO which hit the initial milestones within a couple of weeks/months.