Four Ideas for the New Year

Box, Regency Centers, NCR Voyix, and Douglas Elliman

I had a bit of extra time during the holidays and found some interesting ideas. Please note that I have provided shorter write-ups in the hopes that people reach out to me (or comment) if they have knowledge about the specific companies discussed. I would love to hear from you.

My Substack will always be free, though I would appreciate you sharing it if you enjoy my writing.

Box Inc.

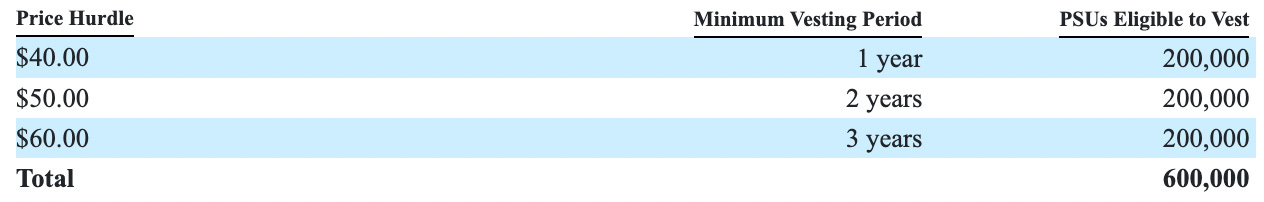

On December 20th, 2024, Box Inc. (NYSE: BOX) filed an 8-K which outlined a 600k PSU grant to its CEO/Co-founder, Aaron Levie. The PSU had the following price hurdles:

With Box trading at ~$32 per share at the time, the price hurdles alone were interesting.

A few things from the 8-K and recent proxy stood out to me:

The price hurdles are high relative to the current price

This would require the stock to increase by ~25%, ~56%, and ~87%, respectively, relative to each hurdle.

The dollar value of the PSU grant is potentially very large

$8MM at $40 per share; $20MM at $50 per share; $36MM at $60 per share

In a change of control, if the stock price is above $40 but below the next hurdle, linear interpolation can be used to receive additional PSU’s

This is only allowed in a change of control situation.

It isn’t clear to me if the minimum vesting time periods apply in a change of control situation

The following paragraph is confusing to me. It seems to only discuss the additional PSU’s awarded via interpolation, and not the overall grant itself.

Box executives are typically provided grants at the end of March or early April

This PSU grant was made in December and is off-cycle.

Levie (Box CEO) has previously declined time-based and performance-based grants in all but one year since the company’s IPO

The only time Levie accepted a stock grant was in April 2018, which were performance-based stock options covering 400k shares. Vesting was contingent on achieving a $28 share price, as well as a four-year vesting schedule.

Levie has a 10b5-1 trading plan in place that was enacted on March 30, 2023

The trading plan’s selling pattern seems to be every ~3 months, routinely occurring in March, June, September and December. This is normal.

The most recent sale occurred on December 12, 2024.

Box’s COO has a 10b5-1 trading plan that transacted after Levie’s PSU grant date

10b5-1 plans have an automatic suspension which stops selling stock if a company is running strategic alternatives. This would mean that a sale process is not currently ongoing.

There isn’t much precedent for such large price-based grants at Box

Box’s COO was provided with a very large (450k share) grant on Dec 13, 2023, but it was completely comprised of RSU’s.

Levie owns ~3MM Box shares with a market value of ~$96MM

This PSU grant covers 200-600k shares, which is reasonably material relative to his current ownership stake.

In addition, Levie typically only draws ~$200K in salary plus benefits from the company. He does not typically receive any other form of compensation.

KKR and a host of other private equity companies are involved in the capital stack through a $500MM preferred share position

The pref shares were issued in April 2021, pay 3% annually, and have a conversion price of $27.

KKR can designate one member to the board and is entitled to vote on an as-converted basis.

Incentive schemes like these price-based PSU’s are common in private equity influenced companies.

While the change of control wording is unclear to me (I am not a lawyer), Levie either thinks the price hurdles are fair given the prospects of the business or he is putting the company up for sale and is broadcasting a minimum starting bid of $40 per share.

Box was rumoured to be for sale in March 2021 given ongoing Starboard pressure; however, nothing materialized. Time will tell if things are different this time around.

Regency Centers

On November 6, 2024, Regency Centers (NASDAQ: REG) amended the severance and change of control agreement with its CEO, Lisa Palmer. A summary of the changes is provided below:

In the paragraph relating to a “Termination occurring other than during a change of control”:

Increased Palmer’s payout from 18 months base salary to 24 months

Increased Palmer’s payout from 150% of average cash bonus to 200%

Increased Palmer’s payout from 18 months of medical benefits to 24 months

In the paragraph relating to a “Termination during a change of control period”:

Changed wording from “higher” to “greater”

Increased Palmer’s payout from 24 months base salary to 36 months

Increased Palmer’s payout from 200% of average cash bonus to 300%

Increased Palmer’s payout from 24 months of medical benefits to 36 months

Original Agreement vs. Amended Agreement

Regency Centers is a $13.3bn REIT that owns ~57MM square feet of open-air shopping centers throughout the US. The centers are primarily grocery-anchored, with top tenants being Publix, TJX, Albertsons, Whole Foods, and Kroger.

Lisa Palmer has been with Regency since 1996, slowly climbing her way up the ranks. She was named president in Jan 2016, nominated to the board in 2018, and named CEO in January 2020. Her yearly compensation is ~$1MM in base salary, ~$2.5MM in STIP, and ~$5MM in equity. Per Regency’s March 2024 proxy statement, Palmer would receive ~$22.7MM in a termination due to a change of control, ~$14.3MM in a qualifying retirement, or ~$13.9MM in a termination without cause.

The question that keeps popping up in my head is: why would the board make these changes to Palmer’s severance contract, and why would they do it now? A few scenarios come to mind:

Palmer’s severance agreement was set to expire

Per the most recent proxy, severance agreements are automatically renewed each year on January 1st. If neither party wants to renew the agreement, then 90 days notice must be provided.

Given the filing date and the automatic renewal, this doesn’t make sense.

Palmer’s severance agreement was not keeping up with industry payout standards for CEO’s

This is a plausible explanation; however, I don’t think her payout amounts were anywhere below market before the changes were enacted.

Regency’s executive severance agreements (including Palmer’s) were not in line with industry standards

This is also plausible but the company only made changes to Palmer’s severance agreement. None of the other executives received any update to their agreements.

There is an activist involved in the background and Palmer is ensuring her payout

This is a possible explanation and would align with Regency’s director nomination deadline being 90-120 days before the previous years AGM date. 90-120 days before May 1 would mean that the nomination window is open from January 1-31, 2025.

It is quite common for activists to approach companies around November/December to start discussions. In addition, activists typically like to look at Q3 earnings before officially engaging with a company. Regency’s Q3 earnings were released on November 1st.

Both the nomination deadline and Q3 earnings announcement would corroborate the timing for why the severance agreement was amended.

This could very-well be the reason why the paragraph relating to a “Termination other than during a change of control” was amended. In this scenario, her severance payout would increase by an additional ~$3.75MM.

There is pressure to sell the company, but Palmer wants to get things in order before officially launching a process

This is a plausible scenario given they changed some wording and increased her payouts in a “Termination during a change of control period”. In this scenario, her severance payout would increase by an additional ~$3.5MM.

All in all, I think it’s reasonable to conclude that Regency may be facing a bit of pressure behind closed doors, possibly from an activist. Given this, Palmer may have approached the board to modify her severance agreement to ensure that she gets an additional payout if she’s terminated after a potential proxy fight or if she’s terminated in a change of control process.

NCR Voyix

Admittedly, NCR Voyix (NYSE: VYX) has a complicated history and I won’t be able to to wrap my head around all the details in such a short period of time.

What I found interesting though, was an 8-K filing outlining some aggressive performance-based RSU’s, combined with the presence of an activist.

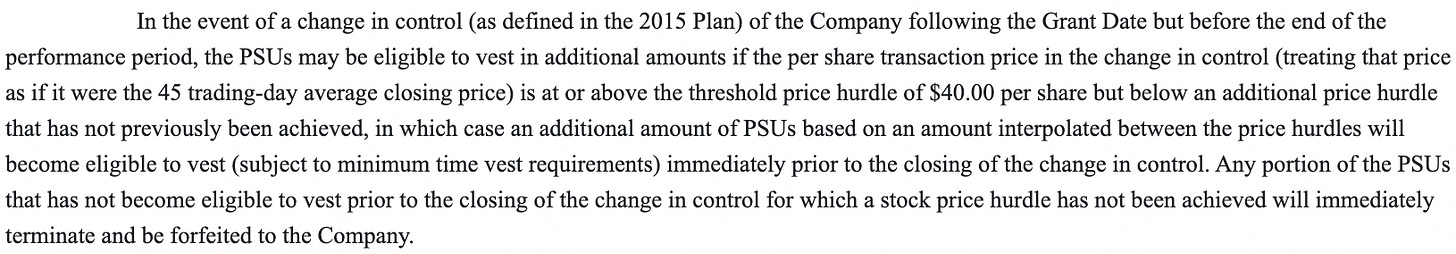

On November 6th, 2024, NCR granted long-term stock incentive awards to a handful of people on their executive team. Here are the pertinent details:

The awards cliff vest after 3 years

The awards are tied to hurdles in the company’s stock price. As of the date of the grant, NCR stock was trading at ~$14.40

Full vesting if the stock reaches $22

125% vesting if the stock reaches $24

150% vesting if the stock reaches $26

In the past, NCR’s long-term incentive awards were based on TSR and relative TSR, not on stock price hurdles

Relative to their current stock holdings, these awards are significant in size for the executives receiving them

For example, the CEO would gain ~208k shares if the stock reaches the first rung of vesting. Based on recent disclosures, the CEO currently owns ~247k shares, in addition to having ~250k in stock options that are currently exercisable.

There is no accelerated vesting if the executive is terminated without cause

Nothing is mentioned in the 8-K about vesting in a change of control situation

The most recent proxy and the 2017 Stock Incentive Plan don’t provide much help either.

Overall, this is quite a bullish grant in terms of price hurdles, as well as dollar size for executives. In addition, Engaged Capital (Glenn Welling) has been involved in the background through a position in the company (and its spinoffs) since 2017. My guess is that Engaged was the primary driving force behind the spinoffs, divestitures, de-levering, and focus on recurring software revenue that occurred throughout the years.

Given Engaged’s activist history, I don’t think an outright sale of NCR should be ruled out. Once one adjusts for the recent divestitures, it could be argued that NCR trades quite cheaply for a recurring software business on both an EV/Revenue and EV/EBITDA basis. I’m not 100% certain of what happens to the grants in a sale, but I would assume full vesting so long as the stock price hurdle is met.

Douglas Elliman

In November 2024, Doulgas Elliman (NYSE: DOUG) granted PSU’s to its new CEO with price vesting hurdles of $3.00, $4.00, and $5.00, whereas DOUG stock was trading at ~$2.70 at the time.

Douglas Elliman (DOUG) is a residential real estate brokerage business focused primarily on the New York Metropolitan area. It was spun out of Vector Group in December 2021, given the differing business lines (residential brokerage vs. tobacco manufacturing). Due to the Vector Group spin-off, many of the executives at DOUG were also executives of Vector Group, including the CEO. Following a 28% drop in revenues and an 85% share price drop since the spin-off, DOUG has deteriorated both as a business and as a stock.

What complicates matters is that Vector Group (which has executive team overlap with DOUG) announced that it was being acquired by JT Tobacco on August 21, 2024, with the closing of the transaction occurring on October 7th, 2024.

In August 2024, DOUG held it’s regular AGM vote, but it’s then-CEO, Howard Lorber, abruptly resigned less than two months later. Lorber’s resignation was undoubtedly related to the closing of the Vector transaction, of which he was able to walk away with a significant windfall. I assume this was enough to push him into retirement given he was 76 years old.

Concurrent with Lorber’s sudden resignation, DOUG appointed one of its board members (Michael Leibowitz) as new CEO effective October 22, 2024. One month later, we were provided with Liebowitz’s employment agreement and compensation details.

$800k salary + bonus

$800k signing bonus

1.5MM RSU’s vesting over three years (~$4MM)

1.55MM PSU’s over a three-year performance period

If the stock price is less than $3.00, then no vesting occurs

If the stock price is above $3.00, 775k PSU’s will be issued (~$2.3MM)

If the stock price is above $4.00, 1.55MM PSU’s will be issued (~$6.2MM)

If the stock price is above $5.00, 2.325MM PSU’s will be issued (~$11.6MM)

Upon a change of control, the RSU’s fully vest. The PSU’s can also accelerate vesting, so long as the minimum stock price target is met.

If Liebowitz is terminated with cause, the RSU’s and PSU’s cease vesting

If Liebowitz is terminated without cause, the RSU’c accelerate vesting, while the PSU’s are still subject to the price hurdles

Prior to Liebowitz taking the CEO role, he sat on the compensation committee with another board member. There’s no doubt in my mind that he had a hand in influencing the specifics of his particular grant.

While I don’t know much about DOUG, Liebowitz has a history of acquiring businesses and selling them off. If a national competitor to DOUG is looking to expand through acquisition or if mortgages rates come crashing down, I wouldn’t be surprised if DOUG stock rocketed higher. Admittedly, DOUG is a turnaround story given current negative EBITDA and a languishing real estate market.

Happy holidays and thanks for reading!

Stocking Stuffer: As already pointed out by Mike on Twitter, Pacific Biosciences recently amended the change of control and severance agreements of its CEO and COO. This tends to happen before a company puts itself up for sale…

Interesting re: NCR CEO. $8M carrot in November, then out the door in February.

NCR Voyix Board of Directors Appoints James G. Kelly as President and Chief Executive Officer

Board names lead independent director Kevin Reddy Non-Executive Chair

The Company reaffirms its revenue and adjusted EBITDA guidance for full year 2024

ATLANTA—(BUSINESS WIRE)—February 5, 2025—NCR Voyix Corporation (NYSE: VYX), a leading global provider of digital commerce solutions, said today that its Board of Directors has appointed Executive Chair James G. Kelly to the role of President and Chief Executive Officer, effective immediately. Mr. Kelly succeeds David Wilkinson, who is stepping down as President and CEO and a member of the Board of Directors. As part of the leadership change, lead independent director Kevin Reddy has been named the Company’s non-executive Chair.

Lorbers resignation might also have to do with the following:

https://www.curbed.com/article/howard-lorber-douglas-elliman-departure-alexanders.html