Canadian Proxy Season Recap

TSX: QBR.B / DNTL / PEY / CGX / LUN / EFX / AYA / MAG / FORA / WED

Over the past few months, I’ve reviewed most of the proxies filed by TSX listed companies. I came across quite a few disclosures that weren’t worthy of a long-form post, but were interesting, nonetheless. Here’s a recap of some top finds:

Quebecor

President and CEO, Pierre Peladeau, was given 4MM stock options on April 12, 2024. The grant was in recognition of him doing the jobs of multiple executives.

The grant timing was normal, but the 4MM amount was not. Historically, Peladeau only received 200-400K stock options per year.

The option strike price is $29.82, and Quebecor stock currently trades at $39.72.

In addition, Peladeau can now elect annually whether to take his salary in the form of cash or stock options.

He chose to receive the rest of his 2024 salary in stock options.

This is a rare bullish signal in an industry that investors have mostly turned their back on.

Dentalcorp

The company made an amendment to their Legacy Option Plan which allows stock option holders to surrender their options in exchange for shares.

It appears that most of the options underlying the legacy plans have exercise prices from $10-18, and expiration dates from 2028-2031.

The stock price today is $8.57, so most (if not all) are out-of-the-money

The exchange formula itself is needlessly complicated.

I don’t know why the company would do this, given most of the options are currently underwater and cannot be exchanged.

Aurinia Pharmaceuticals

Redesigned their LTIP from 50% RSUs and 50% PSUs, to 50% options and 50% PSUs.

The old PSUs depended on hitting revenue targets, but the new ones depend on hitting progressively higher share prices (undisclosed).

The awards were granted at the start of March 2025, which is in line with historical timing.

Size wise, the CEO received 443,973 options and 290,728 PSUs.

The current share price is US$8.09.

The company delisted their shares from the TSX in July 2021, but still reports to SEDAR for some reason. Maybe because they are headquartered in Edmonton, AB.

A large holder/director continues to buy shares aggressively on the open market, and the company recently bought back quite a bit of stock.

Peyto Exploration

Replaced its stock option plan with a TSRRP (Total Shareholder Return Rights Plan).

Essentially, the plan is a total shareholder return (TSR) plan which considers dividends paid throughout the period.

Peyto says that their previous stock option plan only considered share price increases, and not dividend payments. That is the main reason for implementing the new plan.

For executive officers, 50% of their TSRRP’s are subject to performance conditions:

If the total shareholder return is greater than or equal to 8% per year, then full vesting occurs.

Anything below 8% results in no vesting.

The vesting schedule seems overly complicated to me. Peyto provides examples of how it’s calculated in the circular, so feel free to take a look.

Cineplex

Added ROIC and EPS growth metrics to their PSU grants going forward.

It will continue to include a relative TSR component, which was the only measure in the previous version.

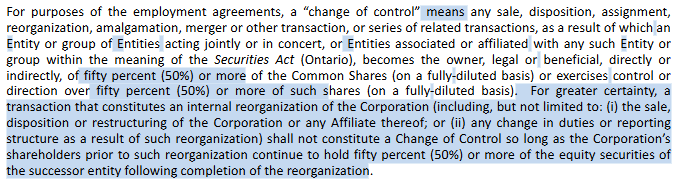

Added some language to their Change of Control benefits (in blue).

Lundin Mining

Executive compensation previously comprised 25% options, 50% PSUs, and 25% RSUs. Going forward it will be 50% options and 50% PSUs.

The PSUs continue to be based on 3-year relative TSR.

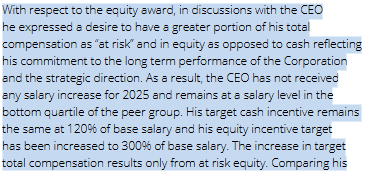

Lundin’s CEO requested more equity incentives; therefore, the board amended his target to 300% of base salary (previously 240%). See below.

Enerflex

The company did a significant overhaul of their proxy filing.

I’m not sure if this is defensive or in response to activist pressure behind the scenes.

The CEO stepped down in March 2025, and multiple board members are “retiring”.

The main items added to the proxy are:

Strict 12-year term limits for board members.

Enhanced succession planning.

Discussions about proactive shareholder engagement.

STIP metrics were changed to include Net Income, SG&A, and Free Cash Flow.

The STIP will continue to have a Safety component, but EBITDA, EBITDA %, and Net Debt metrics have been removed.

The company entered into employment agreements with each of its executives, as a matter of “good governance”.

Aya Gold & Silver

Top members of senior management were granted a retention focused option package on August 23, 2024.

The exercise price is US$10.87, and the current stock price is CAD$14.45.

According to SEDI, the exercise price quoted in Canadian dollars is C$15.63.

The CEO was granted 1MM options, and other members were granted 500-750k options.

Executives have rarely been granted options historically, and these recent grants are reasonably large in size.

MAG Silver Corp

The company updated all of the employment agreements with each NEO as of January 1, 2025. Changes include:

Termination without cause payments were increased by 3-6 months base salary, plus prorated bonus.

Change of control protection periods were increased by 6-9 months.

Verticalscope Holdings

On October 17, 2024, the company granted 500k PSUs to its Founder/CEO, which are based on stock price targets.

The specific vesting tranches were not disclosed, but the share price milestones range from C$6-25. The stock currently trades at $3.95.

The milestones must be reached within the first 48 months following the grant, which is incredibly quick.

Historically, the CEO has only earned ~$1MM in total compensation, so this PSU grant is relatively large for him.

Oddly enough, this PSU was not reported in the SEDI database.

Westaim Corporation

Entered into a private placement and PSU grant on April 3, 2025 with its now largest shareholder. The shares were bought at an implied price of $28.50, and there are additional warrants attached, which only vest once the shares reach $48.00.

The placement also includes an investor rights agreement which allows the shareholder to nominate an additional board member if the $48.00 target price is met before April 3, 2030.

I have never seen a clause like this before.

The PSU grant is for 673,727 shares, and only vests if the same $48.00 target price is achieved. The value of these PSUs is significant if achieved.

As of today Westaim shares trade at $31.66.

Without doing an in-depth analysis of each situation, it’s impossible to tell if there are any smoking guns. If anyone follows these companies closely and can provide some additional insights to piece the puzzle together, it’d be greatly appreciated.