I have next to no knowledge of Molina Healthcare’s (NYSE: MOH) fundamental business, but recent performance stock units (PSU’s) make me think that something’s going on.

On October 17, 2024, Molina Healthcare issued a press release outlining a one-time grant to their CFO, Mark Keim. This caught my eye because CFO’s aren’t usually the recipients of these types of retention grants. The grant was in the form of 53,074 performance stock units, which are contingent on hitting 2027 EPS goals and continued employment during that time. This doesn’t seem that odd until you realize that Molina stock trades at +$300 per share, which valued the PSU’s at ~$17.5MM.

I started digging further and realized that Molina’s President/CEO was also the recipient of a one-time grant on August 19, 2024. The only difference being the magnitude of the award. The CEO received 146,184 PSU’s, with an estimated value of ~$50.6MM.

Given that both of the awards were in the form of PSU’s, no Form 4’s were filed and the accompanying EPS targets were not disclosed. As of today, both the CEO and CFO own ~$110MM and ~$15MM shares in Molina, respectively, without including the recent grants. The bottom line being that these new grants are incredibly large relative their current ownership.

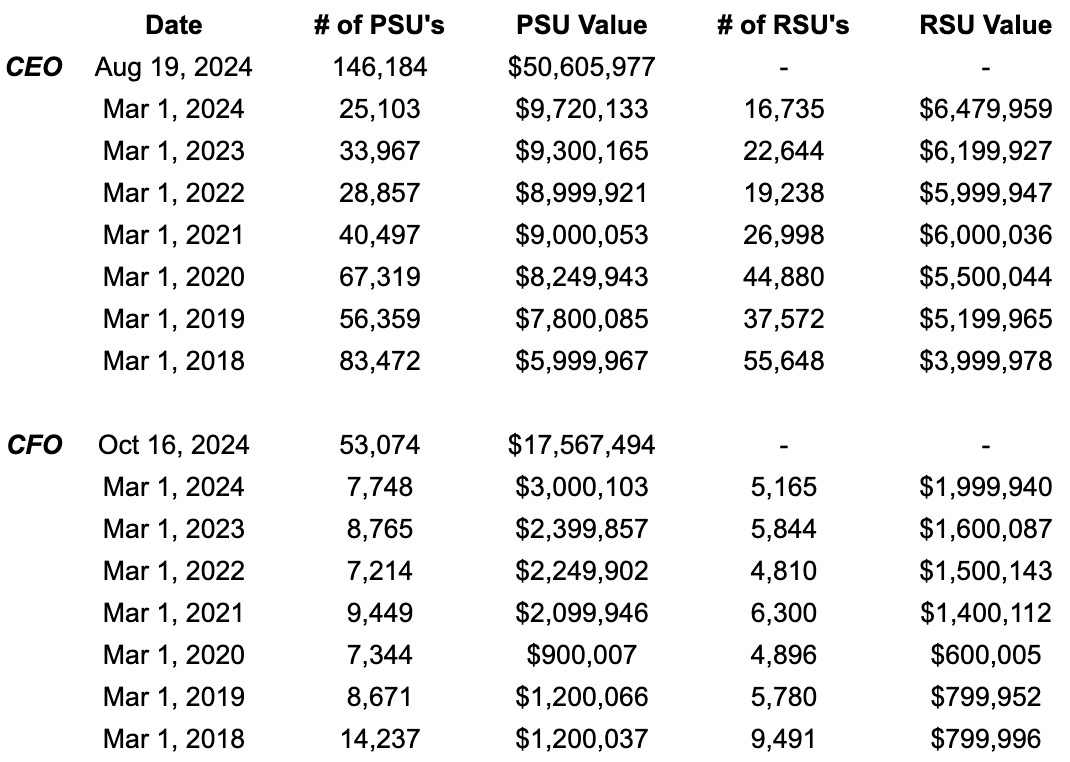

The below table outlines the historic long-term PSU and RSU grants to the company’s CEO and CFO. Both the amount and timing are odd.

As is the case for one-time grants, they are not typically thought of by the board. Usually, executives with disproportionate power will broach the subject with board members and pitch it as a retention grant. In Molina’s case, the stock has outperformed significantly since both the CEO/CFO came on, which likely reinforced their bargaining power.

If I try to put myself in the shoes of Molina’s CEO/CFO, I’d only push for a large PSU grant in four possible circumstances:

The 2027 EPS target for the PSU’s is artificially low and the grants are essentially free money, given the three-year time-vesting.

The exact wording in the PSU award says “…eligible to vest subject to the achievement of adjusted earnings per share (“EPS”) goals for fiscal year 2027 which are consistent with the Company’s expected long-term growth rate and strategic plan.”. I then pulled up the most recent investor day presentation from May 2023 which states a targeted goal of 15-18% yearly EPS growth for the next three years. The majority of this coming from organic growth, and a smaller portion from acquisitions. Given this public guidance, I don’t think that they sandbagged the 2027 EPS target in the PSU.

The 2027 EPS target for the PSU’s is reasonably difficult to hit, but the CEO/CFO have a much rosier outlook for Molina going forward.

In my opinion, executives would only agree to a high EPS hurdle if they had an informational edge leading them to believe in a very high probability of hitting the 2027 EPS target. I wouldn’t go as far as saying that they have material non-public information (MNPI), but more like a casino game where the odds are heavily tilted in their favour.

Executives are looking to make debt-funded acquisitions and/or share buybacks to increase EPS and hit the 2027 EPS target.

This is certainly a possible outcome given that Molina has spent ~$1.3bn on acquisitions since YE 2019, and in the past three years, half of their revenue growth has come from acquisitions. Unfortunately, the compensation committee also has the right to adjust the PSU goal posts under “specified events” such as “material corporate transactions”.

The board recently approved a $1bn share buyback program in October 2024 after announcing a separate $750MM buyback program in September 2023. The May 2023 investor presentation discloses ~2% in yearly EPS growth due to share buybacks, which helps, but only accounts for a small amount of the targeted 15-18% EPS growth.

The PSU’s have clauses which allow the CEO/CFO to de-risk the award if they put the company up for sale.

There are two PSU clauses which pertain to a change of control scenario:

If the company is acquired and the PSU award is not continued/converted with the same terms, then 100% of the PSU award will vest at “target” immediately.

If the company is acquired and the award is continued/converted, then 100% of the “target” PSU will convert into a solely time-based vesting award in the successor entity.

The fact is, no CEO/CFO is going to lobby for such a large one-time grant unless they believe, on a risk-adjusted basis, that the stock is cheap today relative to what is being priced-in.

Unfortunately, I don’t know what’s going to happen and I don’t know Molina well enough to add much more value. Per 2024 guidance, Molina trades at ~13.5x earnings compared to peers trading anywhere from 10-20x.

I think it’s reasonable to conclude that the CEO/CFO think that the stock is cheap and that the 2027 EPS target is more than achievable. Grants such as these should make you proceed with caution though, given that the payoff may not always align with investor outcomes.

Executives have a “heads I win, tails I don’t lose” bet, which is hard to compete with.

P.S: If anyone has any insights on Molina which may tie into the bigger picture, I would love for you to message me or comment with your thoughts.

so after the investor day, when they edged down the EPS growth targets (still mid-teens), do you think the PSU grants reflect anything or just management enrichment? since investor day the company has issued $750M debt. leaves a lot for buybacks or acquisition.